|

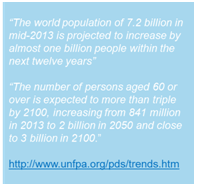

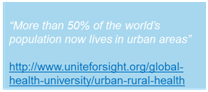

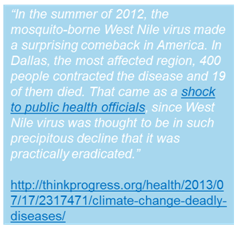

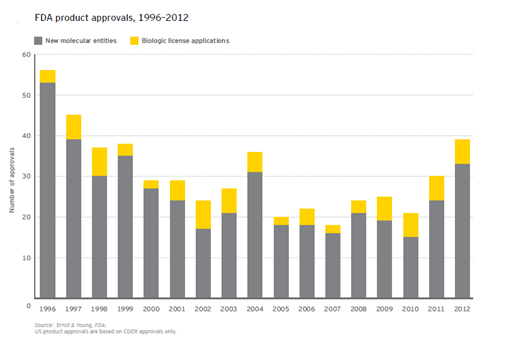

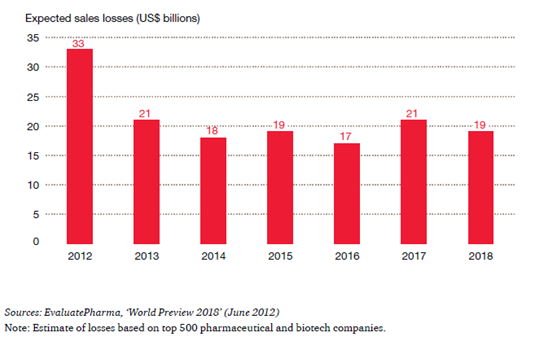

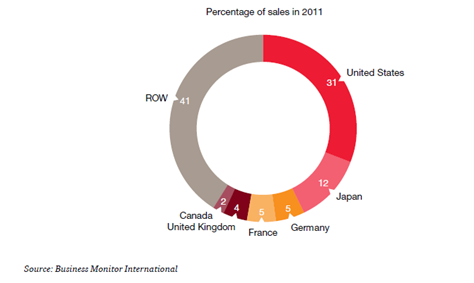

Trends Driving the Increased Importance of Medical Affairs & Best Practices for Preparing to Address Them Introduction The Medical Affairs function within Life Sciences companies has significantly broadened and increased in importance in recent years. This is the result of forces both inside and outside of the industry, which have driven change in nearly every aspect of business. These forces include rising healthcare costs and changing payment structures; world population dynamics; environmental factors; and transformations along the entire value chain of the Life Sciences industry. This report examines the trends that have led to the increased significance of Medical Affairs. It also offers some best practices for addressing the growing demands on the Medical Affairs function, which now encompasses the many facets of liaising with scientific peers, experts and healthcare professionals; authorities and health institutions; and patients and communities. The valuable information included in this report is a compilation and analysis of research executed using publicly available data; as well as a comprehensive study conducted by Cegedim, including interviews with industry stakeholders on their pain points, objectives and current capabilities within the space. This report is the first in a planned series of white papers on the topic of Medical Affairs. Mega Trends Driving Change As the Life Sciences industry(hereinafter referred to as the Industry) continues to be affected by a host of macro trends,it has become increasingly imperative for today’s industry leaders, managers, partners and investorsto grasp the full impact of these mega trends. Healthcare Costs First and foremost, economic tensions represent obvious challenges for authorities and payers—and, as a consequence, affect the way the industry operates. The share of healthcare costs in the real economy continues toincrease, driven by the “cost disease” linkedto the very nature of care procurement, which is requiring a personalized intervention of skilled professionals to address the needs of each patient. Even in emerging countries generating sizeable economic growth, the incremental wealth is not sufficient for governments to ignore the surge of the share of healthcare costs in the real economy. In OECD countries, the cost of healthcare as a share of GDP averages 9.3% based on data from either 2011 or 2013,depending on availability. That cost ranges from 6.6% in Luxembourg to a whopping 17.7% in the US. These expenses increase at an average of 4% and the public share of the funding is on average 72.2%. Yet, there are considerable variations. In the US, it is as low as 47.8%.In the Netherlands, the public share reaches its highest pointat 85.6%and is growing slightly faster than the average 4.1%.(*1) In this environment, the share of the total healthcare costs absorbed by the pharmaceuticals and other medical supplies (non-durables) represents a meager 16.4% on average, yet there are wide disparities—from an extreme low in Norway (6.8%) to its highest point in Hungary (33.4%). This important fact has an obvious impact on government funding and reimbursement policies—also having aninfluence on the industry’s approach to market access.Additionally, this average has been declining over the past decade, prompting the Life Sciences industry’s recommendation that a more holistic and transparent view of healthcare costs is warranted—beyond the sole focus on cost of the drugs.(*2) World Population Dynamics Second, the world population is simultaneously expanding and aging. The growth of the middle class in emerging economies creates new customers seeking quality healthcare at affordable prices—representing challenges for the authorities, the payers and the industry. The impact of this trend is reflected in the approaches aiming tomaximize access to care in an affordable manner, such as tiered pricing. (*3) hird, as the world population is increasingly concentrated in urban areas, it facilitates greater access to care, scientific information, and medical information through digital media. As a consequence, the population is more aware, demanding, and willing to challenge the medical authority.The population now seeks more accurate, comprehensive, reliable and trustworthy information.Thus, today’s industry must ensure that the patient represents a pivotal stakeholder in its communication and educational initiatives. (*4) Environmental Factors Fourth, the environment is now characterized by change.Decreasing water and air quality as well as climate change result in conditions that promote the spread of infectious and vector-borne diseases; the rise of respiratory disorders; and, in some cases, certain forms of cancer,which has been recently demonstrated. This macro trend challenges public health authorities, which are driven to arbitrate between the various healthcare priorities to allocate their resources. Increasingly, these public priorities must now be factored into the development strategies of the Life Sciences industry. The Impact of Transformation Enterprises now deal with the impact of these macro trends in combination with their own intrinsic challenges to maintain profitable growth and ensure theirreputation of a trusted provider with consumers. The Industry has experienced considerable declinein R&D output as all the low hanging fruitshavelong been harvested (see graph below). The most recent products to belaunched are specialty care products thataddress more targeted indications.Theancient blockbuster model is now being modified since large primary care products are falling prey to the generics. As such, productsare evolving towards smaller, and sometimesniche,market segments. These products are characterized by the larger amount of complex scientific and medical information that support the regulatory submission and, by their more focused scope of indications, reflect the fact that they address better defined unmet medical needs. As fundamental science linked to genomics and proteomics is increasingly leveragedbythe Industry, the resultant products for specific patient subgroups now better address the patients’ aspiration for more tailored—if not personalized—medicine. These newer products are also raising issues of affordability even in developed economies.This trend will most likely lead to new approaches towards pricing and reimbursement (i.e. coverage by public or private payers)to ensure an appropriate level of access to these therapeutic novelties. The combination of the R&D drought and the deflation of revenues caused by patent expiration (see graph, from PWC, From Vision to Decision, Pharma 2020) has prompted the industry to focus on minimizing the time to market and the time to peak sales for any new product launch.Yet, this strategic intent is hindered by the strengthening of the regulatory requirements that complicate—through costs and possible delays—various stepsall along the value chain, from research to development to manufacturing and all the way to commercialization. The evolving nature of how companiesreplenish their portfolios, increasingly with more specialty care and biological products, is impacting the industry’s approach to arbitration along the clinical development path—especially the need to terminate the development of the least promising drug candidatesas early as possible.This evolution also affects enterprises’ ability todocument the payer value proposition and ensure the sustainability of the demonstration of its innovation value.This is especially true as the bulk of the profitability comes from mature economies where the healthcare systems are cash-strapped and increasingly cost-conscious (see graph, from PWC, From Vision to Decision, Pharma 2020).As the industry is challenging the public payer authorities’ approach to drug cost-cutting,recommending a more holistic approach to simultaneouslydeal with healthcare costs and reach better health outcomes, this trend is increasingly critical. Positively, the focus of all stakeholders is increasingly on the patient. More specifically, this focus is directed on the patient’s experience as a consumer of care. All entities involved are learning thatpatient satisfaction is likely to become one of the most crucial key performance indicators (KPI). Reaching such a goal will requireoptimizing technologies, information and health provider options to reach effective and sustainable diagnosis, treatment and follow-up implementation. This will beachieved through a more efficient allocation of resources in which patients, nurses, health centers, patient associations and others are increasingly involved in supporting the higher cost actors (specialists, hospitals, etc.).This will hopefully lead to improved outcomes due to factors such as proximity, and the ability to have a closer, more personalized follow up to promoteadherence to the treatment following diagnosis. The underlying idea is to have each stakeholder focus on what he can do better—at an affordable cost for the system. In light of the intensification of the competitive pressures (*5)and of the ever increasing downstream hurdles along the value chain, from clinical development, to registration, to market access, to product launch and commercialization (including drug utilization studies, risk management plans and observational trials), the Industry has been adjusting its organization and functions to successfully address these challenges. A relevant example is the growing use of patient registries to accelerate translational research as well as to assess the benefit-risk equation during the registration phase. This phase is of growingimportance as it serves the stageat which a company calibrates its commitments with respect to the health authorities.(*6) In regards to the market access phase, it’s noteworthy thatthis phase in stretching beyond the post-regulatory periodto the entire product lifecycle, hence affecting the corresponding Industry’s resource allocation. The phasebegins with a negotiation based on indicators of clinical utility, savings and efficiency—forming the basis of the commitments made by companies that must be delivered during the commercial life of the product. In the context of science-driven specialty careand progressivelycost-conscious ecosystems, the Industry is also adopting a new approach towards partnerships and information management—shifting its emphasis to delivering results. With patient satisfaction becoming the ultimate KPI, all stakeholders involved are seeking positive outcomes and overall savings along the care procurement pathway.Further, the degree of consumer/patient engagement is strongly correlated with the perceived degree of satisfaction(*7). With patients now footing an increasing share of the healthcare bill, this trend expands in its significance. Thanks to the ubiquitous connectivity that allows easier access to informationand the inquisitive attitude directed towards prescribers, patients are evolving into responsible partners in the management of their own health, and the Industry is adjusting its approach to the patients accordingly. Today’s partnerships are increasingly innovative and include the academic world, government agencies and nonprofits. The common currency is a focus on accurate, comprehensive, reliable and trustworthy information about the product, the disease, care procurement and patient management. Additionally, the industry now demonstratesa more holistic stance in the way it handles market access. Beyond the focus of understanding and rationalizing the patient journey, ensuring the outcomes that it committed to in its negotiations with payers, the industry is exploring and experimentingwith new approaches to deal regardingaffordability or “willingness to pay”(*8&*9). This is exemplified by the increasing number of risk-sharing agreements, especially in the fields of specialty care where the voices of healthcare providers are adding to the chorus of patient advocacy groups demanding lower prices and affordability for all clinically eligible patients(*10). The industry has to completely reset its approach to the current ecosystem, as seen inspecific areas, to be better prepared in the eminentevolution of the rapidly changing, evidence-driven and cost-conscious healthcare environment. Strategically fit enterprises must be able to manage fragmented patient flows and provide products and services in new settings. They must open early lines of trustworthy communication with key stakeholders to be regarded by payers as reliable partners in the decisions leading to negotiation and trade-offs. Companies must master their internal processes to ensure information quality across multiple channels, both traditional and digital, irrespective of the data source and the target audience. They must be able to assist stakeholders in managing small and well-defined population segments to deliver specific outcomes. It’s critical that enterprises understand how to engage successfully with healthcare consumers. If the Industry as a wholecould deliveron all the above mentioned ideals, companies would be better positioned to build lasting rapport and trust—fostering the belief among the stakeholders that enterprise interests are aligned with their own. Yet, to execute such changes successfully, doesthe industry need a mere reboot or a much more substantial DNA change? Medical Affairs: The Keystone For background on the industry’sorganization, the operational functions of the Life Sciencesinclude research, manufacturing, licensing and commercialization—all of which the value chain is built upon. Thecontrol-focused functions include departments such as finance, human resources and legal. But owing to the specific nature of its products, the Industryrequiresan additional layer of control-focused functionsincluding regulatory, medical, global marketing and compliance. The Medical Affairs function is at the crossroads of operations and control.Historically, it has served as the bridge between the industry and its stakeholders viathe medical community. This function is uniquely tasked with managing external relationships with the scientific community as well as with patient groups, authorities and beyond. (*11)Medical Affairs teamsdeal with added complexity due to the more stringenttransparency regulation across the markets that affect the industry globally. For example, from the moment a company begins operations in the US, all its activities, including those outside the national territory, must comply with US regulations. To this point, a report published by First Word in May 2013 takes a deep dive into the impact compliance is having on MSL activity. (*12) Learnings from ourCollaboration Event Acknowledgingthe critical role of Medical Affairs in value creation, effectiveness and impact regardingthe healthcare industry, Cegedim is currentlyendeavoring to design atailored solution to address these expectations.To that end, we have initiated a process of exploration and co-creation, starting with an in-depth assessment of the needs as expressed by the industry experts. We searched the available literature and organized a live seminarunder the format of an advisory board meeting. We collected insights fromknowledgeable professionals with firsthand experience: local and regional Medical Affairs directors, heads of MSL teams, MSLs and Medical Affairs consultants. Additionally, industry executivesprovided theirmanagementperspective and shared their expectations from the medical departments. Theremainder of this papersummarizes the meeting’soutcome and includestestimonials from the attendees. “We need to ensure that Medical Affairs delivers credibility and subsequently contributes to boosting company reputation.”General Manager, Europe, Global Life SciencesCompany The impacts of the megatrends-induced transformations presented earlier in this paper were analyzed in detail:

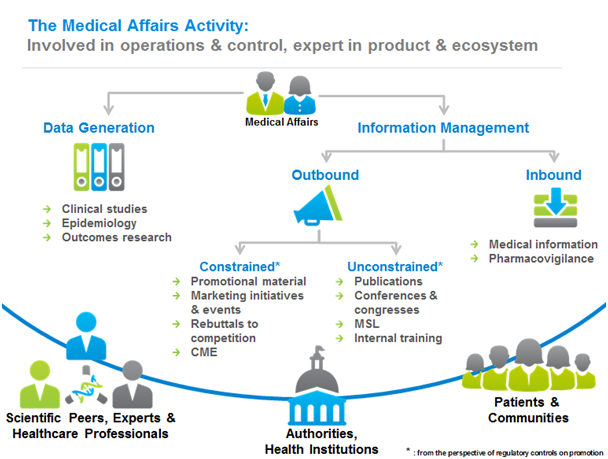

Practically speaking, these skill sets translate into activity. Medical Affairs generate data, whether clinical, epidemiological or outcomes research. Moreover,Medical Affairs manages information flows, both inbound and outbound. Inbound flows refer to medical information and pharmacovigilance.Outbound flows refer first to the most constrained channels including detailing, marketing initiatives, and in general terms, the resources linked to commercialization functions; second, for thoseoutbound flows exclusively targeting the scientific and medical community, they arehandled by the Medical Affairs functionin the form of publications, medical conferences, etc. In all cases, information management is strongly affected by regulation, adding an extra layer of complexity as while regulation principles tend to be common, implementation differs from country to country. Therefore, local knowledge and coordination is of paramount importance to align with the specific categories, thresholds and definitions of the different methodologies to communicate. The impacts of the megatrends-induced transformations presented earlier in this paper were analyzed in detail:

“Do we increasingly need a new position in Medical Affairs, such as medical intelligence?”Medical AffairsDirector, EU Affiliate, Mid-size Pharma Company

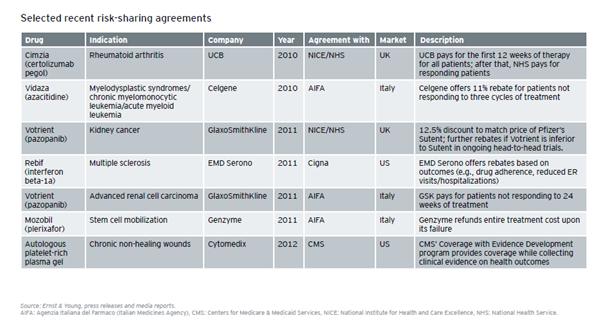

“Do commercial organizations understand the medical aspects of the selling proposition? Oftentimes, there isn’t a shared understanding of the drivers of the value of the product.” Medical Affairs Director, Europe, Global Healthcare Company As theseinterface changes take place, some functions are gaining in importance, especially those with some form of control. Among those, the Medical Affairs role is playing a pivotal role, as it is tasked with ensuring the integrity, comprehensiveness and reliability of the medical and scientific information. As such, Medical Affairs accounts for a sizeable share of the company image and intangible value. “All the intelligence collected by Market Access, Medical and Marketing teams should be fully integrated.” Medical Affairs Director, Eastern Europe, Global Healthcare Company “Data is evidence. We need to move to outcomes from our data repositories, to support the risk mitigation tactics.” Medical Affairs Director, Europe, Global Healthcare Company The industry, along with all its stakeholders, is rightly concerned by the additional risk of product misuse or inadequate patient adherence fostered by incomplete or inadequate information content or dysfunctional information flows. In addition to the possibly dire consequences for the individual patient, the impact on the company reputation can be far reaching. In extreme cases, the financial consequences can reach catastrophic proportions.An example being the case of market authorization cancellation with the inevitable domino effect on company profitability and stock valuation, as well as affecting the level of trust in the company from both authorities and consumers.A case sponsored by the scientific community and supported by scientific evidence presented in a suitable way to meet the different stakeholders’ needsand to address both medical and socio- economic parameters will demonstrate the value of the product and thus provide the foundation towardsits approval, pricing negotiation and use implementation. Agile, efficient information management flow ensuring content quality—up to date, accurate, complete and adapted to the audience’s need—becomes a complex task. As organizations increasingly demand that their medical departments take a leading position throughout the drug life cycle,the development of transversal cooperationtakes on a greater importance. Medical teams can offer precious insights and calls to action to support other functions in presenting the product scientific core value adapted to the regulatory, market access and launch key stakeholders. The key to success is: • Anticipation to ensure compliant delivery • Readiness ofteams’ expertise • Adaptation of content • Readiness of thecommunication process “Medical Affairs should be the internal bridge, starting with their R&D colleagues, and all the way to commercialization, always bringing the medical data into the action.” Medical Affairs director, EU affiliate, Mid-size Pharma Company “Medical Affairs is not a support function! It’s an acting function, a full partner of the plan execution, with a complete set of accountabilities.” Medical Affairs director, EU Affiliate, Mid-size Pharma Company Conclusion To effectively implement best-in-class processes, Medical Affairs need to be able to measure and monitor its activity and outcomes. Organizations must define clear performance indicators for the medical function and the collaboration with others. These measures should bring insights into strategy fulfillment, the level of success and be linked to a set of triggers that alert the medical function to take timely action when deviations and risks are spotted. Considering the massive investments and efforts in new drug development, healthcare companies cannot afford mishaps in communication management and execution delays that would negatively affect the success of a product launch. “We are down to P&L by territory, ensuring we achieve these is a shared responsibility in which medical also participates ensuring the right scientific evidence is effectively presented.” General Manager, EU Country, Mid-size Company We will be following up with a subsequent white paper, exploring the KPIs and the supportive tools and processes to back the full execution of the mandate of Medical Affairs. Cegedim will be deploying and further evolving our new solution to address the cited needs and expectations. Future white paper editions will report on the actual benefits brought to our customers after real life implementation of our solutions and recommended best practices. Appendix, References & Bibliography: (*1)http://www.oecd.org/els/health-systems/oecdhealthdata2013-frequentlyrequesteddata.htm Source: OCDE- Health Data- 2013 (*2) http://www.efpia.eu/topics/industry-economy/pricing-of-medicines (*3) http://www.unfpa.org/pds/trends.htm (*4) http://www.uniteforsight.org/global-health-university/urban-rural-health (*5) Accenture Report: The New Reality: Maximizing Product Launches in the Post-Blockbuster World (*6) http://www.randdreturns.com/a-history-of-time-to-market-thinking-in-pharma/ (*7) Bain & Company, Healthcare 2020 (*8) https://obroncology.com/obrgreen/article/Cost-Challenges-in-Developing-New-Oncology-Drugs (*9) http://jco.ascopubs.org/content/31/28/3487.full (*10) Ernst & Young, Biotechnology Industry report 2013, Beyond borders – Matters of evidence (*11) BCG Perspectives, Raising the bar in biopharma medical affairs (*12) First Word Expert Report, MSL-KOL Engagement: Ensuring Compliance (2nd Edition), May 2013 Executive Summary The evolution of the socio-economic and regulatory framework is driving companies to increasingly balance their investmenttowards real life medical and behavioral data. This trend is fueled by the evolving nature of the stakeholders’ demands, and a divergence between the demands of the historical stakeholders (Authorities, Payers, Health Care Professionals (HCP)) seeking to document the collective benefit in a more robust and effective way, and the emerging demands from the patients as individuals, whose concern is their personal benefit. Aligning HCP andpatients oncare procurement objectives and execution is often hampered by their respective need to process different and complex amounts of incomplete data to determine what is the best course of action for each individual; meanwhile, authorities need to make sure they make the right decisions to maximize the efficiency of the care procurement system and simultaneously meet the societal expectations. The concept of Adaptive Licensing has emerged from the authorities’ need to ensure adequate and timely access to therapeutic innovation, while balancing theongoingdemand to assess new therapiesin a standardized context through clinical trials withthe disruption it brings into the healthcare system. Real life dataemerges as the answer to the latter expectation and opens a new challenging space to understand how better outcomes can be obtained:from how to practically procure careto how patients should behave. New indicators are needed, yet are difficultto generate and open a new dimension of risk management. In this paper we analyze the elementsof the challenge and the aspects to be considered to ensure a reliable process to contribute to better health outcomes, with the contribution expected from the healthcare industry, starting by the Medical Affairs function. Driving changes & Medical Affairs -Introduction The macro trends on economic pressure, world demographics and environmental change together with the mutation of the portfolio of the life science industry linked to the R&D drought and shift towards more specialized and complex products addressing chronic conditions in more precisely profiled patient populations conjure up to position Medical Affairs as a critical function to lead internalcollaboration among the operational and control functions in the organizations and externally with the heterogeneous stakeholders and specialized scientific community. All this has to be executed in full compliance with regulation boundaries to preserve the integrity of company assets and reputation and deliver a valuable health outcome contribution. The ultimate goal and key performance indicator (KPI)is the satisfaction of the patients as the consumersof healthcare – which suggeststaking a holistic approach that ultimately delivers abalanced combination of clinical, economic and social utility. Data Layers Medical evidence is the core foundation of all medical affairs activity. Its responsibility evolves intimately with the changes of the insight generation, starting with data collection. Today, the following factors are changing data collection:

The information Medical Affairs has to manage goesbeyond the results of the clinical trials . There are several layers to be assessed and worked-on together:

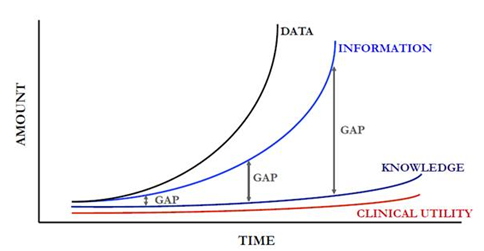

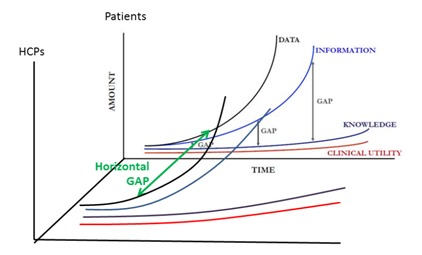

Evidently, this understanding of the patient-related dimensions need to be supplemented by the relevant data pertaining to the healthcare providers, up to complex dimensions including their responsiveness to certain types of interactions, their digital profile (including their activity on social networks and openness to digital communications) and their connections to and recognition by their scientific peers. From Data to Clinical Utility In the process to get from data to utility there are several steps, and we observe that the bigger the data input is, the more the gaps among the steps grow. This is illustrated by the graphbelow From Data to Information:\ The medical and scientific information is not only expanding in terms of volume and content complexity, it is also structured in different ways and could be incomplete. Yet, comprehensiveness, trustworthiness and reliability are the desirable attributes of the medical information needed to meaningfully feed the analysis, hence raising the bar on the quality of the information collection and storage practices. Therefore, the data needs to be analyzed to derive actionable insights. The algorithms that will be used to analyze the data will face increasing scrutiny and should stem from collaborative work bycapturing the input of medical experts, payers and regulators, so as to be balanced.

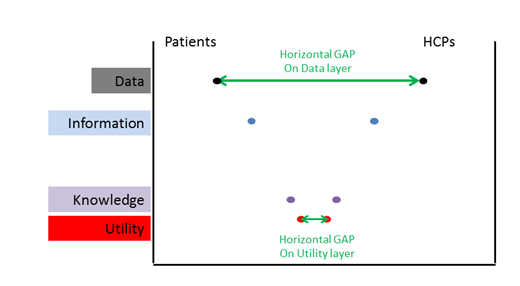

Convergence Curves of data, information, knowledge and clinical utility exist not just for the scientific community (which medical affairs belong to), but also for the rest of the stakeholders. Each group will have a different set of available and accessible data (wherethere will be some overlap). To simplify the reasoning,this paper willconsider only theHCP and the patients. The diagnosis of the disease and the decision regarding the best course of action to follow are both becoming more complex.The same difficulty is amplified downstream at the patient level, since the patient-facing healthcare providers often do not have enough time or the adequate interpersonal skills to communicate effectively with the patients, most of the latter lacking the relevant educational background to leverage thedata (which they access in an incomplete way, assuming what they have access to is reliable…) Consequently, not only do we have a “vertical” gap between information and knowledge that increases, but we also have a”horizontal” gap between the HCP and the Patient curves. This gap would ideally getsmaller as we go alongthe process from using different sets of data into more elaborated levels of knowledge to eventually converginginto matching understanding and conclusions regarding clinical utility. The representation of the transversal cut would be in form of V: Evidently, the reality isthat the considerations, priorities and decision processwill be substantiallycorrelated with the role of the stakeholder. We face a micro and a macro challenge here, and the two may be pulling decisions in opposite directions. From a doctor’s perspective, when looking at personalized medicine the issue is convergence towards what is most appropriate for each specific patient. From a public health provider – especially the payers – point of viewthe challenge is to balance the collective and individual benefit.

Therefore, the foundation of the decision should remain intimately linked to the trustworthiness of the data, the ethics and technical accuracy of the algorithm to process the data and the productive interfacingbetween the stakeholders whowill all have to join forces to set the right investment priorities and optimize health outcomes. Medical Affairs possesses the capabilities to act as the broker to:

Medical Affairs With technology dramatically increasing the amounts of available information, the speed in its generation and broadcasting, and its ubiquity,the healthcare industry and in particular Medical Affairs is under pressure.: . Technology should be leveraged to manage the transition from relevant and accurate data to clinical utility insights. Since the algorithms used to mine and analyze the data have an impact on the conclusions, their design should rest on the combination of disease, drugs and patient journey knowledge. As this combined knowledge is residing in Medical Affairs, this function is ideally positioned to be a pivotal contributor into the design of said algorithms.Lastly, technology should be the enabler of collaboration around information flows. These flows include those between the Health Care Providers and the Patients, as well as between the Healthcare Industry and the HCPs and the Patients as well. It is of the utmost importance that the data is accurate, transparent, comprehensive and trustworthy, and that the technology provides state-of-the-art analytics on all dimensions, including the behavioral one, to provide a comprehensive integration and generate actionable insights to support decision making. Medical Affairs already had a significant task set:

Nowadays, theMedical Affairs role has evolvedbeyond clinical data from randomized and controlled trials, into real-life medical data and even beyond, into real-life behavioral data as long as they can be interpreted to maximizeclinical utility and treatment outcomes. The future challenge encompassestwo pivotal dimensions: comprehensiveness and quality of the vast amount of data and trust among stakeholders, as behavioral info accessedby the industry should be strictly limited to what is relevant to the optimal use of the medication according to the patient status and profile, towards the desirable treatment outcome. The remit of Medical Affairs is therefore expanding to getting the 360 view of the patient. If the purpose is the design and substantiation of the value proposition brought by a novel therapy, the ensuing question is,”How far should the industry push the limits in terms of partnering with the data companies to generate a perspective on patients’ behaviors yielding insights supporting decisions to maximizeclinical utility in a given population?” The combination of the insights from the 3 types of data (Randomized Controlled Trial(RCT) clinical data, Real World (RW) medical data, RW behavioral data) should form the three pillars of the value proposition required to convince the authorities of the product value in a given environment or healthcare ecosystem. Moreover, at the individual level, it should empower the physician even more as well as the patient community with the right level of knowledge to elicithealthier behaviors. What is happening? Companies are transitioning from a purely sequential processto manage the product life cycle in which they focused in R&D first, then Regulatory then MarketAccess, with different teams accountable for each phase in semi-isolation; towards a collaborative dynamic where the R&D, Medical Affairs and Market Access teams collaborate in parallel from the early stages of clinical development. The main challenge is to progress from handling only clinical data from randomized trials to expanding the data scope and including real world evidence, both clinical and behavioral. The teams do not often have all the skills or resources to collect, process and leverage the latter type of data. Therefore, the recommended path to successfully managing this complex evolution of building the value proposition to support novel therapies is partnering. Internal teams would then focus on shaping the data to generate knowledge and clinical utility insights as well as devise the approach to deliver the message to each stakeholder in an effective and impactful manner. In addition to the content, the focus of internal collaboration between industry functions should also be on devising the most relevant mix of media channels to address the expectations and preferences of the stakeholders and engage them in lasting and trustworthy relationship. The new indicators resonating in the Medical Affairs space, as more data is combined and the ecosystem changes, are progressively more practical and down to patients’ quality of life impact and overall satisfaction with their experience as a client/consumer of the healthcare procurement. Real life outcomes andsocio-economic value which is becoming critical when talking about real life adoption and adherence are someof the keys to success. The engagement and alignment of the scientific and medical opinion leaders remains pivotal to analyze, interpret, endorse, and to act as acommunication channel, that strengthens the perception that the proposition is accurate, transparent and trustworthy. Conclusion With the complex environment described: better profiled patients and medical conditions, more focuseddrugs supported by larger and increasingly complex evidence, heterogeneous stakeholders accessible through a wider range of media, including digital; increasing constraints (mainly in the form of cost controls or regulations) and evolving data requirements. Medical Affairs is positioned as the function with the most suitable set of skills and capabilities to lead this transformation, from the shift in data generation to the communication flows throughout the drug life cycle in collaboration with the rest of the company functions. Because of the complexity of the task and the materiality of the goals described on this paper, the way forward is engagement and partnering to join forces. Success requires smoothly functioning partnerships to maximize effectiveness. Medical Affairs are relative small teams – albeit expanding – that will require support to collect, digest and produce the evidence, conclusions and information. To operate smoothly with so many parties and specialized matters, proper information, analytics, stakeholder engagement and relationship management are required. How to improve R&D productivity: the pharmaceutical industry’s grand challenge, Steven M. Paul et al., Nature Reviews Drug Discovery 9, 203-214 (March 2010) Economist intelligence unit survey, July 2012 http://www.scripintelligence.com/home/Healthcare-2030-facing-up-to-a-pharma-future-346693 Pharma Futures 4, Shared Value, 2011 – report http://pharmafutures.org/pharmafutures-4/shared-value/ Eichler HG et al., Adaptive Licensing: taking the next step in the evolution of drug licensing. Clin Pharmacol Ther. 2012 Mar;91(3):426-37. doi: 10.1038/clpt.2011.345. Epub 2012 Feb 15 Barker R, Garner S, Adaptive drug development and licensing. Regulatory Rapporteur 2012; 9, 10: 13-15 Comments are closed.

|

MRGN AdvisorsMRGN Advisors Archives

October 2020

Categories |

RSS Feed

RSS Feed